There is quite a bit of truth to the old adage “there is no free lunch in life” or its more recent equivalent “if you’re not paying for the product, you’re the product” because pretty much everything in life comes at a cost these days.

Which is probably why many of us ascribe a certain value to items we pay for, in a sliding scale, depending on what we pay for the product. In other words, the more we pay for something, the more valuable we tend to think it is. And following that train of thought, the more we pay for something, the more likely it is to be of a certain quality.

But while that might hold true for items like clothing, cars or computers, the same cannot be said for investment products. When it comes to investing, if all other factors are equal, an investor would likely be better off choosing the product that costs less. Because every dollar paid in costs, is a dollar less in returns. And over time, these costs do add up.

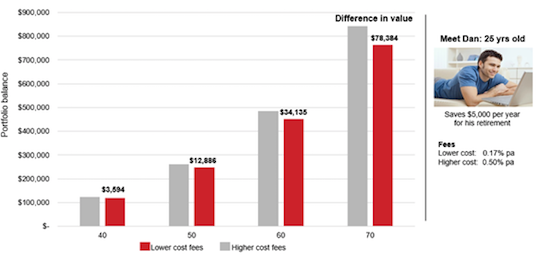

The chart below illustrates just how much these costs add up over 45 years for a portfolio that returns an average of 5% annually, before costs. The difference of 0.33% in a fund’s management expense ratio (MER) does not seem like much at first but over the course of the long-term, it does add up… to nearly $80,000.

Source: Vanguard, using data from Morningstar.

Note: The portfolio balances shown are hypothetical and do not reflect any particular investment. The final account balances do not reflect any taxes or penalties that might be due upon distribution. Assumption: 5% returns less MER. The example is illustrative only and is based on the factors stated.

But MERs are not the only costs in investing. Generally, there are two types of costs or fees that investors should be aware of, transaction fees and ongoing fees.

Transaction fees are fees charged every time you execute a transaction. For instance, brokerage costs or spreads if applicable, when you buy a managed fund or ETF.

Ongoing fees are expenses that are incurred on a regular cadence, such as an annual account maintenance fee, custodian or administrative fee.

It is also important to note that the focus on fees is not limited to investments outside super but also your superannuation fund. If you’ve selected a specific super provider for its low MER, make sure that you’ve also looked at other possible costs such as contribution fees (the fee on each extra sum you put into your investment), administrative fees or any other fees you might be charged.

So just like how it makes sense to shop around for the best price on a car, computer or service, make sure you do your research and calculate how much you are paying in investment costs. And if you find a better provider or fund, be sure to consider the consequences of selling out of your existing fund or transferring your assets before you make the move.

Vanguard

vanguard.com.au